From $29,900 to $2 Million: The Shifting Landscape of Home Affordability

- Rich Arzaga

- Aug 1, 2025

- 1 min read

Updated: Dec 14, 2025

By Rich Arzaga, CFP®, CCIM, The Real Estate Whisperer® Financial Planning

In May 1972, my parents bought their 4-bedroom, 2-bath home for $29,900. It probably felt like a financial stretch at the time. But today, that same kind of stretch looks very different.

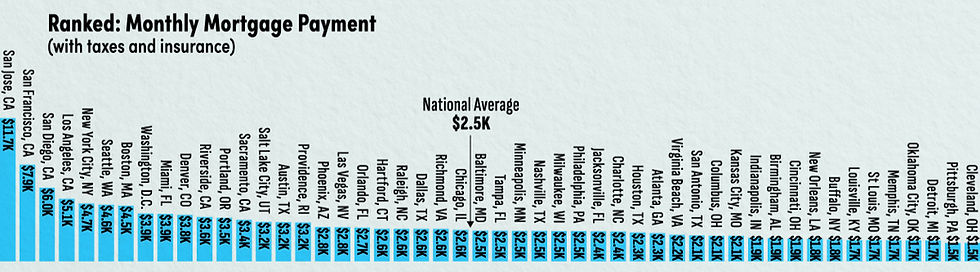

Fast forward to 2025: According to Visual Capitalist, the median home price in San Jose, CA tops $2 million, requiring an annual income of $501,800 to afford the monthly payment. That’s not a luxury home—that’s median.

Take a look at the chart to see how much income is needed to buy a median-priced home in 50 U.S. cities. Whether you’re in San Antonio ($90K income required), Miami ($165K), or Seattle ($198K), affordability varies widely depending on where you live.

A Few Things to Notice:

National median home price (2025): $402,300

National salary needed to buy: $108,486

Highest income required: San Jose, CA – $501,800

Lowest income required: Pittsburgh, PA – $63,600

Whether you're planning your own next move or advising others, this is a striking reminder of how much the math—and the mindset—around home buying has changed in just a few generations.

Comments